Updated on : April 19, 2023

Master Data Management Market Overview, Industry Share & Forecast

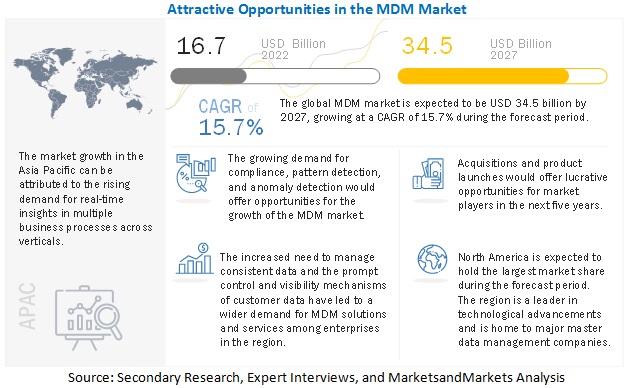

The global Master Data Management Market size worth approximately $16.7 billion in 2022 and is poised to generate a revenue around USD 34.5 billion by the end of 2027, presenting at a CAGR 15.7% from 2022 to 2027. Various factors such as Increase in the use of data quality tools for data management, and rising need for compliance are expected to drive the adoption of master data management solution and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic has affected every industry drastically, especially the IT industry; among which the hardware business remains the most affected. Due to the global country-wise lockdown, the industry faced a noticeable slowdown in manufacturing and supply of the hardware components. The software and service businesses had also shown a severe slowdown for a short period. However, the adoption of cloud-based technologies, collaborative applications, security solutions, big data, and AI helped the IT industry recover faster during and after the lockdown.

The pandemic has affected the master data management market also. Quarantine and other COVID related enforced measures slowed down the growth of the market. But once these restrictions were lifted, the market started to recover. To reduce the risk of a COVID-19-positive employee infecting the entire workforce, and placing businesses under quarantine again, organizations came up with smart quarantine solutions consulting to businesses. Hence, various master data management solution providers have launched the ‘work from home’ resource centers and incorporated work from home modules to their existing master data management systems, owing to the growing ‘work from home’ popularity. For instance, in response to COVID-19, NICE launched a free work-from-home module for its employees to help them cope up with the increased call volumes and minimize rising handle times while staying safe from getting infected.

Master Data Management Market Dynamics

Driver: Increasing use of data management tools

master data management solutions and services channel massive volumes of data generated across an enterprise to store data in a single location and guarantee data security. To improve operational excellence, the increased data churn necessitates sophisticated data quality technologies. Data quality is the first step toward implementing master data management, a powerful tool that allows businesses to trace the stages of information flow and document data transformation. Data quality technologies assure data accuracy, while master data management solutions automatically update records and clear superfluous data. This has allowed businesses to combine the adoption of master data management solutions and data quality technologies. For instance, maintaining data integrity is critical for businesses in the financial services industry. In 2017, Northern Europe and IT users regarded master data and data quality management as very important, according to BI-SURVEY.com. Data quality technologies aid in the reduction of data duplication, rework, and the maintenance of reliable data records. Data consolidation is becoming increasingly critical for firms who have realised the value of data quality. This factor is boosting the master data management market by creating a high demand for master data management solutions.

Restraint: Concerns regarding data security

Master data management software and services are evolving as the best way to structure and keep data in these times of rising data management and maintenance solutions. However, due to widespread user worries about data security, this market’s expansion is limited. Organizations are currently operating in data-driven business environments, which raises the danger of advanced data breaches, cyber-attacks, and phishing attempts. Several issues arise as a result of data being spread across multiple systems, increasing the security risks to the data. Isolated data systems, on the other hand, are a constraint for many firms that face a significant risk of security breaches and distributed data. According to the Ponemon Institute LLC’s sixth annual benchmark study on the privacy and security of healthcare data, healthcare firms are more vulnerable to data breaches than other industries. One of the main reasons for the slow adoption of master data management solutions is this. Users avoid these solutions because they are afraid of losing critical master and reference data if data mistakes occur during compilation or upgrade.

Opportunity: Incorporation of advanced technologies with master data management solutions

New technologies such as artificial intelligence (AI), big data, and machine learning (ML) are propelling the master data management market forward. This technology provides new technical capabilities for data storage and processing, as well as huge dataset availability. Customers have a broad range of requirements as new technologies’ capabilities in managing multi-domain and multi-faceted data have improved. The most common request has been to integrate master data management solutions with technologies like as Big Data, analytics, and business intelligence. Duplicate records are identified and data quality is assured, which are common master data challenges. It also verifies records based on information outside the master data management application, such as transactional data, CAD data, and the history of transactions. The use of machine learning in master data management is growing, allowing fresh data to be considered while relying on previous data exchanges. Organizations can use machine learning to detect patterns in data, as well as propose linkages, correlations, and speedier data adaption from a source to a consumer. Enterprises can integrate the source for eCRM, personalization, social commerce, and offline activity with the help of these technologies, resulting in a single data source for all channels. Furthermore, innovative players such as Amazon, Google, and Facebook are using new technology to accelerate development. To avoid inflicting any damage to their brand, they’re combining master data management with other modern technologies to give complete, consistent, and accurate information across all channels.

Challenge: Diversified data regulatory implications

Master data management solutions are gaining traction in a variety of industries and across different locations. This has resulted in a considerable barrier to market growth, namely the presence of diverse governmental rules and policies across national and international borders. For example, to protect data both within and outside Europe, the European Union General Data Protection Regulation (GDPR) is strictly followed. For vendors supplying services in different regions, the extent of this statute differs. Furthermore, master data standards varies among industries. Each business has its own set of data requirements, which makes it difficult for master data management solutions to satisfy the needs of the organisation. In comparison to other industries, pharmaceutical and biotech companies are expected to follow new product master data requirements. Pharmaceutical firms must adhere to ISO 11615, ISO 11616, ISO 11238, ISO 11239, and ISO 11240, which were produced by the International Organization for Standardization (ISO). As a result, the presence of governmental regulations poses the challenge of diversity and variation which significantly hinders the broad expansion of the master data management market.

The cloud segment to witness higher CAGR during forecast period

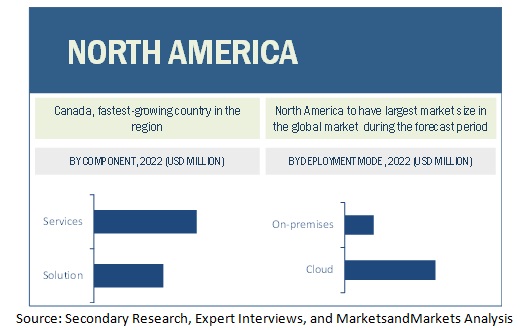

Based on deployment type, the master data management market is segmented into cloud and on-premises. Cloud-based deployment type enables businesses to operate without a server infrastructure or office location, thus allowing remote working. Organizations adopting cloud-based master data management solution since it is easy to deploy, offers agility, and provides more scalability than on-premises tools and software at a lesser cost. These factors are supporting the growth of the cloud-based master data management solutions.

The BFSI vertical to account for the largest market size during the forecast period

The segmentation of the master data management market by the industrial vertical includes BFSI, government, healthcare, retail, IT and telecom, manufacturing, energy & utilities, and others. Presently, the BFSI sector is the leading segment of the master data management market. A massive amount of financial data is generated regularly in this sector from transactions comprising sensitive and detailed financial & transactional data and information about customers. So, to keep these data secured and accurate, and for efficient management, financial institutions, such as banks, companies, and insurance agents use master data management solutions. These solutions help these financial institutions improve customer service and manage business risks.

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the master data management market. Key factors favoring the growth of the master data management market in North America include the increasing technological advancements in the region. The growing number of master data management players across regions is expected to further drive market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the master data management market include IBM (US), Oracle (US), SAP (Germany), SAS (US), TIBCO Software (US), Informatica (US), Talend (US), Cloudera (US), Riversand (US), Broadcom (US), Ataccama (Canada), Stibo Systems (Denmark) and Teradata (US). The key players have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market.

Report Highlights

Report Metrics

Details

Market size value in 2022

US $16.7 Billion

Market size value in 2027

US $34.5 Billion

Market Growth Rate

15.7% CAGR

Regional Scope

North America

Key Market Drivers

- Increase in the use of data quality tools for data management

- Rising need for compliance

Key Market Opportunities

- Incorporation of new technologies with master data management

- Trend towards multi-domain master data management

Segments covered

Component, Deployment Type, Organization Size, Industry Vertical, and Region

Geographies covered

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

Companies covered

IBM (US), Oracle (US), SAP (Germany), SAS (US), TIBCO Software (US), Informatica (US), Talend (US), Cloudera (US), Riversand (US), Syn Force (US), Stibo Systems (Denmark), Profisee Group (US), Reltio (US), Semarchy (US), Broadcom (US), Ataccama (Canada)

This research report categorizes the master data management market based on component, deployment mode, organization size, application, industry vertical, and region.

Market by Component:

- Solution

- Services

- Consulting Services

- Integration Services

- Training & Support Services

Market by Deployment Mode:

- Cloud

- On-premises

Market by Organization Size:

- SMEs

- Large Enterprises

Market by Verticals:

- BFSI

- Government

- Retail

- IT & Telecom

- Manufacturing

- Energy & Utilities

- Healthcare

- Other Verticals (education, aerospace & defense, travel & hospitality, transportation & logistics, and media & entertainment)

Market by Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Singapore

- Rest of APAC

- MEA

- United Arab Emirates

- Qatar

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2022, IBM updates it’s InfoSphere MDM Reference Data Management Hub, with the new update users can fine-tune the data they publish using the MDM Publisher function. Users can now filter down to the row level when establishing the data filter criteria that determines which data gets published. This feature can be used to slice master data finely based on the criteria users specify.

- In February 2022, Oracle updates it’s Oracle Enterprise Data Management, With the new update, validation errors can be downloaded to an MS Excel file. This enables EDM users to obtain assistance or feedback from others. The file contains specific information, such as the nodes, properties, relationships, and failure messages.

- In April 2022, Broadcom updates it’s CA IDMS, the new update comes with DML modification statements that update the database’s record occurrences. Users can remove a record from the database’s database and can make a link between a member record and a set.

Frequently Asked Questions (FAQ):

To speak to our analyst for a discussion on the above findings, click Speak to Analyst